Use your everyday purchases to accumulate savings for investment, starting as soon as today.Ĭompetition is tough between three of the sought-after apps: Acorn, Robinhood, and Stash. You don’t have to save up for years before you can invest in a single stock, bond, or mutual fund. You don’t have to worry about transaction or brokerage fees sign up for a minimum of $1 a month, register your debit or credit card and the app will use your purchase history to do the math and make an investment deposit. These apps can link to your debit cards and make recurring deposits by taking tiny amounts of money, rounding up your daily transactions, and investing them into exchange-traded funds. This is where our Acorns vs Robinhood vs Stash comparison comes in. You can now even venture into commission-free investment by downloading the right apps.Īs all three are strong contenders, it may be confusing for you to choose the most suitable one. These apps have made the investment plain and simple. Many platforms have been introduced that encourage and allow you to not only regularly save small sums of money, but also invest your savings.Īcorns, Robinhood, and Stash, all are examples of these modern platforms. Micro-investing is another latest product of our technologically driven era. See Related: Why is it So Hard to Save Money? Micro-Investing Platforms That’s what makes micro-investing so easy and accessible. Unlike the traditional method, you don’t necessarily need to have tons of cash on you. This makes it very easy to start an investment plan with your current financial situation. Micro-investing allows you to invest small amounts of money, whether it’s pocket change or your paycheck. You don’t even have to know the traditional investment lingo to start the process. With micro-investing, you can save up and invest within your budget. Micro-investment is a modern answer to all your investment-related worries and limitations. Should you be monitoring it at all times?.Whether it’s for a retirement plan, a vacation, a car, a house, or to merely have money to fall back on if things go awry, it’s always a smart idea to have an investment plan in place.īut for those of you who are new to investing, it may seem like a daunting task. So, what exactly is micro-investment, and why is it trending nowadays? Micro-Investing – What is the Best App?īefore moving onto the micro-investment apps mentioned in the title, it's important to understand the basics of micro-investment.Acorns vs Robinhood vs Stash: Comparison.How Good is Acorns as a Micro-Investing App?.For example, it doesn’t list expense ratios for ETFs or give any details on their holdings, so you’ll want to do some outside research first before you buy. On the downside, Jamieson said she found Robinhood’s simple approach frustrating. Next add investments you are interested in to your watchlist to see how their price changes each day. To get started, you’ll need to link your bank account and deposit money into the app. This minimalistic app, which claims nearly four million users, works best if you already know what you want to buy, as it does not provide much research on your investment options. ETFs also have fees of around 0.5 percent or less built into their price

ROBINHOOD VS STASH FREE

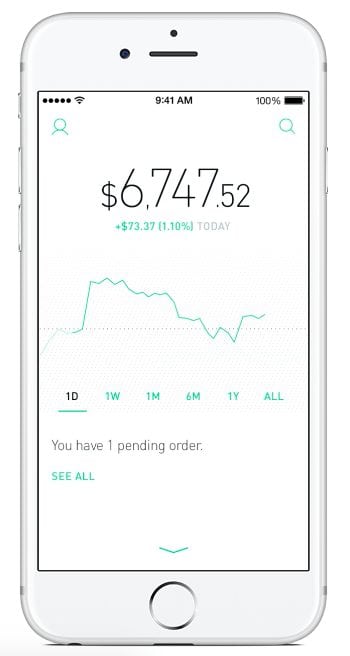

Minimum to invest: No minimum balance to open an account but you need to purchase at least one share of a stock or ETF.įees: Free with free trading for domestic stocks, up to $50 for foreign securities. You can also trade options and invest in crypocurrencies, including bitcoin, ethereum, and litecoin, in some states. Investment options: More than 5,000 investments, including most stocks listed on US exchanges and nearly 500 ETFs.

0 kommentar(er)

0 kommentar(er)